How Much Housing Wealth Do You Have?

The recent dip in the stock market has people looking once again at real estate as one of the safest investments there is, if not the safest.

With prices predicted to continue to increase, homeowners may not be aware of the equity they currently have in their properties.

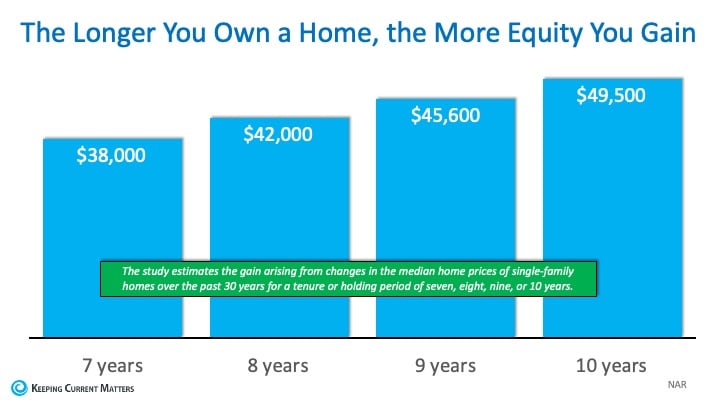

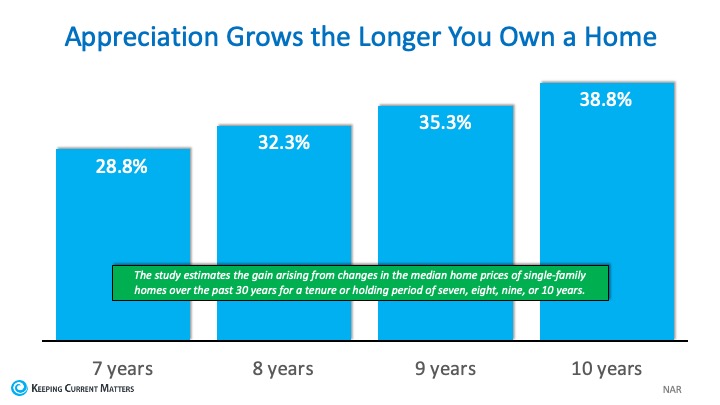

Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30 years based on the length of homeownership.

How much have home prices increased?

One of the first measures of the financial benefits of homeownership is the net worth (in the form of equity) an owner can build over time. The study showed the average increase in home values based on how long homeowners stayed in a home.

What was the percentage of appreciation?

Another way to look at this is by the percentage increase in value over time, called appreciation:

Bottom Line

Home ownership has many financial and non-financial benefits. The accumulation of “housing wealth” through increased equity is a major one. If you’re thinking of buying a home for the first time or moving up to your dream home, the sooner you make the move, the sooner your net worth will begin to grow.

Many experts believe that with the combination of increased home equity and historically low interest rates, many home owners are in a great position to make that next move. This will also break the log jam at the medium priced and starter home market.

For more on this, please check out the latest edition of Hank’s internet program, “Morning Coffee.”

Enjoy your week…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass