Why Not a Condo as Your First Home?

Having a difficult time finding a first home that’s right for you and your wallet? Well, here’s a tip – think about condominiums.

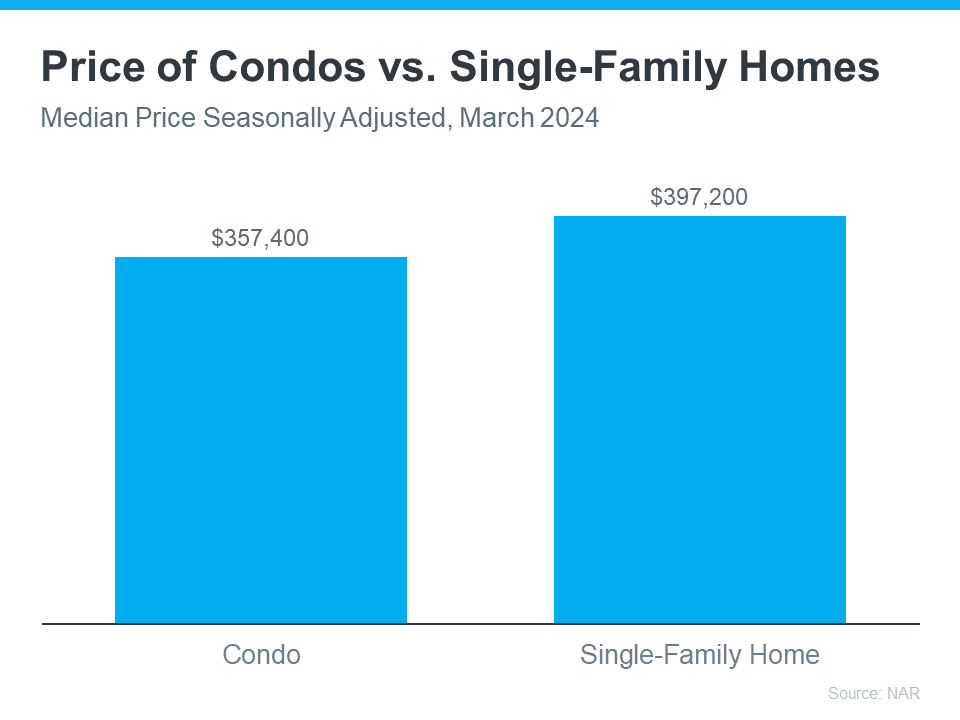

They’re usually smaller than single-family homes, but that’s exactly why they can be easier on your budget. According to the latest data from the National Association of Realtors (NAR), condos are typically less expensive than single-family homes (see graph below):

On Cape Cod, the median price for a condominium year-to-date is $450,000. A single family home? $725,000.

So, if you’re comfortable with a smaller space and want to buy your first home this year, adding condos to your search might be easier on your wallet.

Besides giving you more options for your home search and maybe fitting your budget better, living in a condo has a many other perks, too. According to Rocket Mortgage: “From community living to walkable areas, condos are a great option for first-time homebuyers and people looking to enjoy homeownership without extensive upkeep.”

Let’s dive into a few of the draws of condos for first-time home buyers, according to Bankrate:

They require less maintenance. Condos are great if you want to own your place but don’t want to mow the lawn, shovel snow, or fix the roof. We can help explain any associated fees and details for the condos you’re interested in.

They allow you to start building equity. When you buy a condo, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

They often come with added amenities. Your condo might come with access to amenities like a pool, golf course, tennis/pickleball courts, or organized activities like movie nights, guest speakers, and group activities.

They provide you with a sense of community. Buying a condo means you’ll be living close to other people, which is nice if you enjoy having neighbors around and making friends.

Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the homeownership door, so you can start to gain equity. Later on, that equity can help you buy another place if you need something different.

Ultimately, owning and living in a condo is a lifestyle choice. If it’s one that appeals to you, they could provide the added options you need in today’s market.

We moved to a condo two years ago after living in a single family home for 28 years. Yes, there is an HOA fee that we pay every month that’s an expense we didn’t have before. But, the lawn is mowed, the snow shoveled, and regular outside maintenance is taken care of. These were all things that we were paying others for. We also have a pool that our granddaughter enjoys. And we don’t have to take care of that either!

At our community’s Annual Scholarship Banquet this past Friday, we awarded a $1,000.00 Mari Sennott Plus/Today Real Estate scholarship to a graduating senior. In total over $40,000.00 was raised by residents for scholarships.

So, there’s a lot to be said for adding condos to your search. They have a lower price point; it’s easier to save money because of reduced expenses, and there are often amenities and activities that make living there enjoyable.

Curious about your options and how condos could be a good first options? Let’s chat at 508-360-5664 or [email protected].

Talk soon…,

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass