Should You Move with Current Mortgage Rates?

When mortgage rates spiked over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy?

In today’s market, data shows more homeowners are getting accustomed to where rates are and thinking it may be time to move.

As Mark Zandi, Chief Economist at Moody’s Analytics, explains: “Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

We’ve been posting fairly consistently on Mondays and Fridays on our social accounts some national mortgage rates at the end of those days. They have been consistently in the 6% range for some time now. You should check with your own mortgage lender to see exactly what your rate would be. If you’re not working with a reputable lender, we can highly recommend several.

We’ve also put several listings under contract over the last two weeks. Each had busy open houses and multiple offers. Though we did get some offers that were inexplicably below asking price, the winning bids were at or over list.

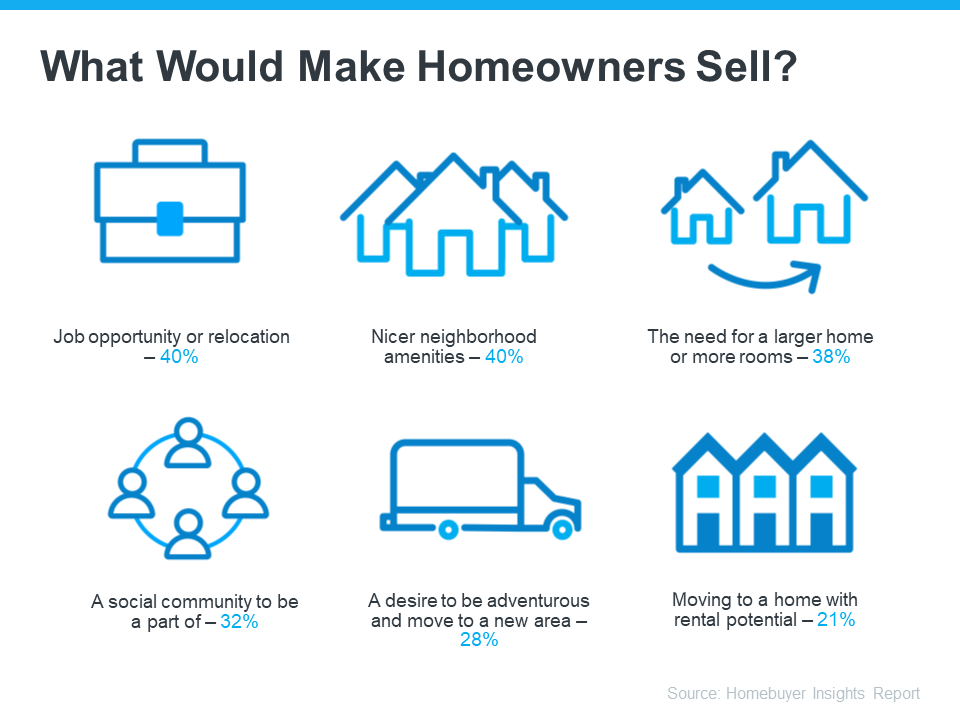

A recent study from Bank of America also shed light on some of the things homeowners say would make them sell, even with rates where they are right now (see below):

What Would Motivate You To Move?

Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income.

And here’s something else to consider. Mortgage rates are still expected to go down over the course of the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends.

You’ll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps.

We can help with that. We’ve sold over 400 homes — including our own in 2022. We can walk you through the plusses and minuses of making a change now. Let’s face it, if you know you have to upsize, downsize, or move to that “someday” neighborhood, how long can you wait? Tomorrow is not one of the seven days of the week.

Let’s chat at 508-360-5664 or [email protected] to go over what matters most to you and whether it’s time for you to make the change you already know you need to.

A quick thanks to everyone who participated in this past Saturday’s Shredding Event. It’s important to protect your identity and we were happy to have Great White Shred available for the third consecutive year to help people safely dispose of their valuable documents. Thanks, as well, to our co-sponsors Patti Lotane/Cape Cod 5 and Aerial Advantage Photography.

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass