Invest in Yourself

Many of you are wondering if it makes sense to buy a home right now. While today’s mortgage rates may seem a bit intimidating, there are two compelling reasons why this is still a good time to become a homeowner.

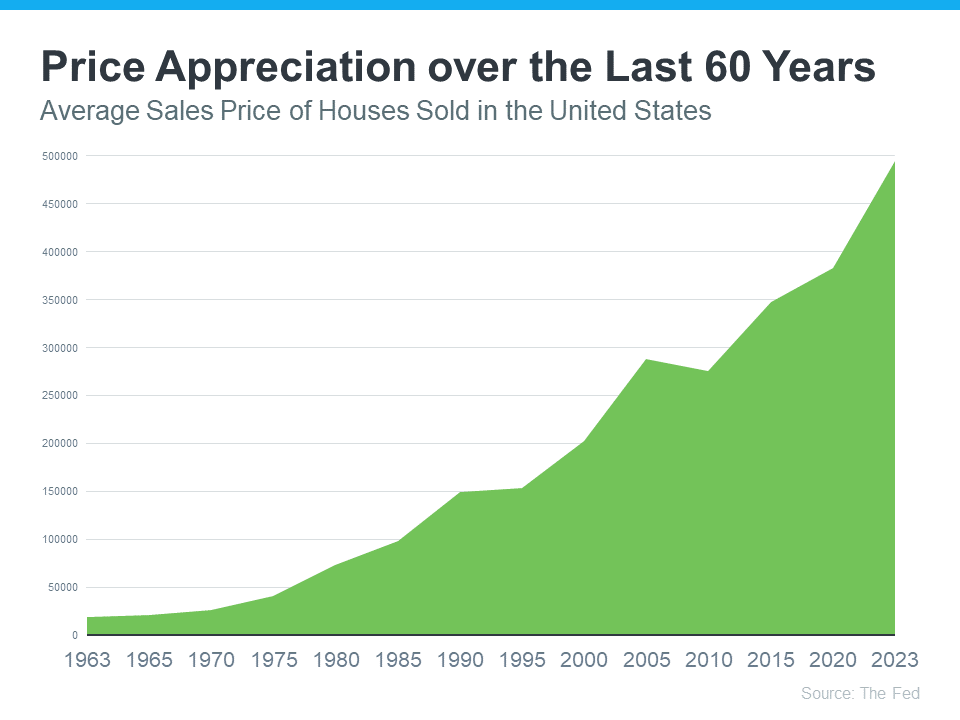

Home Values Appreciate over Time

There’s been a lot of confusion around what’s happened with home prices over the past two years. While they did dip ever so slightly in late 2022, this year they’ve been appreciating at a more normal pace, which is good news for the housing market. While looking at price movement over just a year or two can make you worry if prices are usually this unpredictable, history shows in the long run, home values rise (see graph below):

Using data from the Federal Reserve for the past 60 years, you can see the overall trend is home prices have climbed quite steadily. Sure, there was an exception around the housing crash of 2008 that caused prices to break the usual trend, but overall, home values have been consistently on the rise.

Year-to-date the median sales price for a single family home on Cape is $715,000.00. A year ago at this time, it was $689,000.00. 2021? $607,000.00. 2020? $490,000.00.

Increasing home values is one great reason why buying may make more sense than renting. As prices rise, and as you pay down your mortgage, you build equity. Over time, that growing equity gives your net worth a boost.

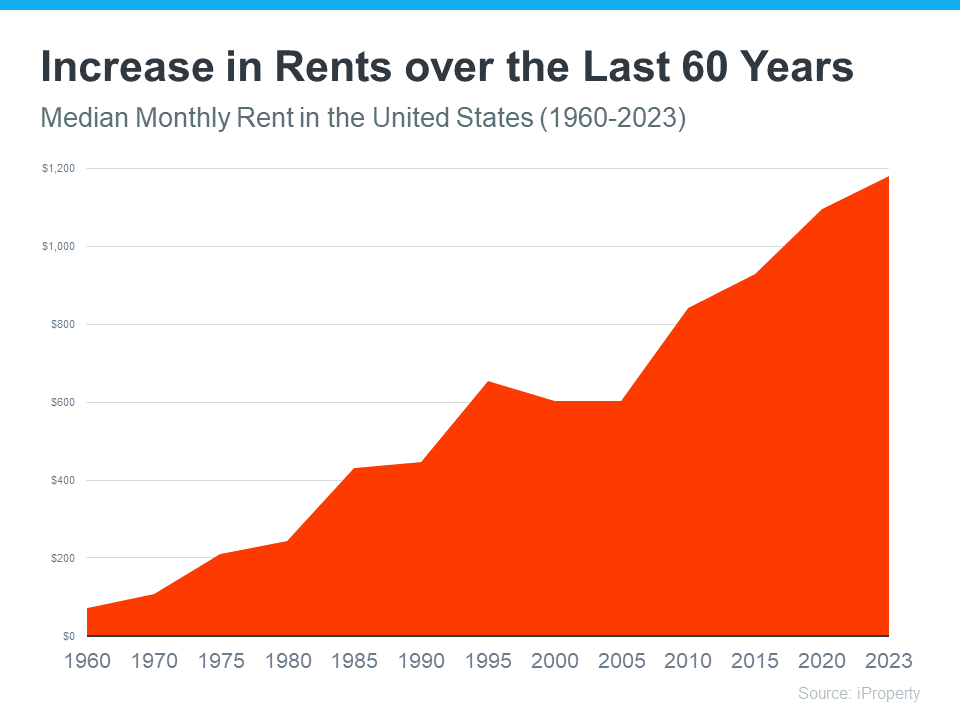

Rents Just Keep Going Up

A second reason why you may want to consider buying a home instead of renting is that rent hikes never end. If you’ve ever felt the pinch of rent increasing year after year, you’re not alone. That’s because, rents have climbed steadily over the past six decades (see graph below):

According to Apartments.com, the average rent for a two bedroom apartment in the Hyannis area is $2,212 per month, an increase of $45 over the last year. (BTW…the average mortgage payment in Massachusetts is $2,323.00.)

When you buy a home, you can lock in your monthly housing costs and bid farewell to those rent hikes. That stability is a game-changer.

In the end, it all boils down to this: your housing payments are an investment, and you’ve got a choice to make. Do you want to invest in yourself or your landlord?

By becoming a homeowner, you’re investing in your own future. When you rent, you invest in someone else’s future.

When you factor in home values consistently rising, plus the opportunity to get relief from never-ending rent hikes, homeownership can be a path to financial security.

If you’re waiting for interest rates to drop to their historical levels of a few years ago, you’re going to be stuck in the position you’re in: paying your landlord’s mortgage and not your own.

As long as supply can’t better meet demand, there’s not going to be a market crash. Even then prices will continue to appreciate

…no matter what your Uncle Bob who “knows a little something about real estate,” says.

If you want to avoid increasing rents and take advantage of long-term home price appreciation, let’s connect at 508-360-5664 to go over your options.

Talk soon…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass