Your Home's Equity Can Offset Affordability Worries

We’ve had several recent conversations with homeowners, who know they should be selling their houses and moving to a properties that better suit their current lifestyles.

Their first home is too small, because they now have three kids. It might be too big since the kids are gone and have lives of their own. Or maybe it’s just time to join up with close friends, who have moved to another part of the country.

But, they feel frozen in place, because of high prices and interest rates that aren’t as low as they were a few years ago.

But there’s a somewhat easy answer to this dilemma that more people should be taking advantage of. It’s called home equity.

Here’s what you need to know.

According to Bankrate: “Home equity is the portion of your home that you’ve paid off and own outright. It’s the difference between what the home is worth and how much is still owed on your mortgage. As your home’s value increases over the long term and you pay down the principal on the mortgage, your equity stake grows.”

In other words, equity is how much your home is worth now, minus what you still owe on your home loan?

How Much Equity Do Homeowners Have Now?

Recently, your equity has been growing faster than you might think. To help contextualize just how much the average homeowner has, CoreLogic says: “…the average U.S. homeowner now has about $290,000 in equity.”

Why? It’s because, over the past few years, home prices have gone up significantly – and those rising prices helped your equity to accumulate faster than usual. While the market has started to normalize, there are still more people wanting to buy homes than there are homes available for sale. This high demand is causing home prices to go up again.

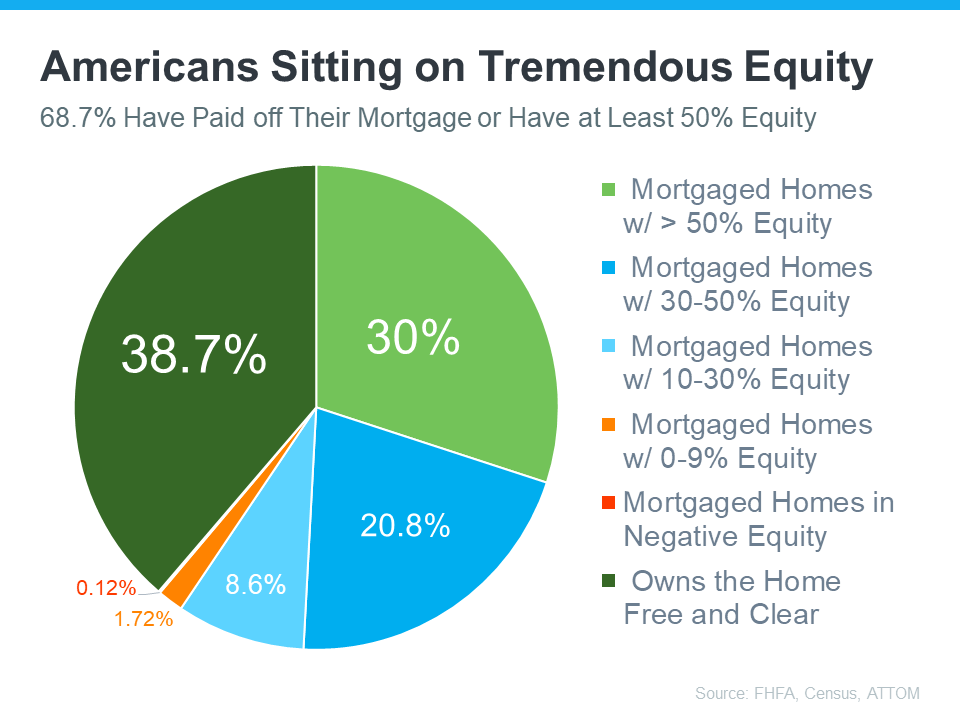

According to the Federal Housing Finance Agency (FHFA), the Census, and ATTOM, a property data provider, nearly two-thirds (68.7%) of homeowners have either fully paid off their mortgages or have at least 50% equity (see chart below):

That means nearly 70% of homeowners have a tremendous amount of equity right now.

How Does Equity Address Your Affordability Concerns?

With today’s affordability challenges, your equity can make a big difference when you decide to move. You can use the equity you’ve built up in your home to help you buy your next one. Here’s how:

Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy a new house without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates.

Make a larger down payment: Your equity could be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money so today’s rates become less of a sticking point.

That’s what we did last year. We used the equity in our home of 28 years as a significant down payment on our new house that better meets our lifestyle today. Our current mortgage payment on our much newer home is less than the one on our old house!

So, if you’re thinking about moving — or know you should because of life changes — let’s talk. We can prepare a Personalized Equity Update for you and share our experience using equity to make our move. We’ll also show you the latest market data.

If you’re looking to leave the area, we can connect you with top flight agents in other parts of the country and the world, who we know through the Tom Ferry Organization.

We’re ready to help. Please let us know how.

Thanks…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass