Don’t Fear the New Adjustable-Rate Mortgage

You may have heard about the return of adjustable-rate mortgages. You possibly thought to yourself: “Oh no, not again.” (We did, too.)

If you remember 2008, you know just how popular adjustable-rate mortgages (ARMs) were. The problems they caused have psychologically impacted the housing market to this very day.

But, after years of being virtually nonexistent, more people are once again using ARMs when buying a home. Let’s break down why that’s happening and why this isn’t cause for concern.

Why ARMs Have Gained Popularity More Recently

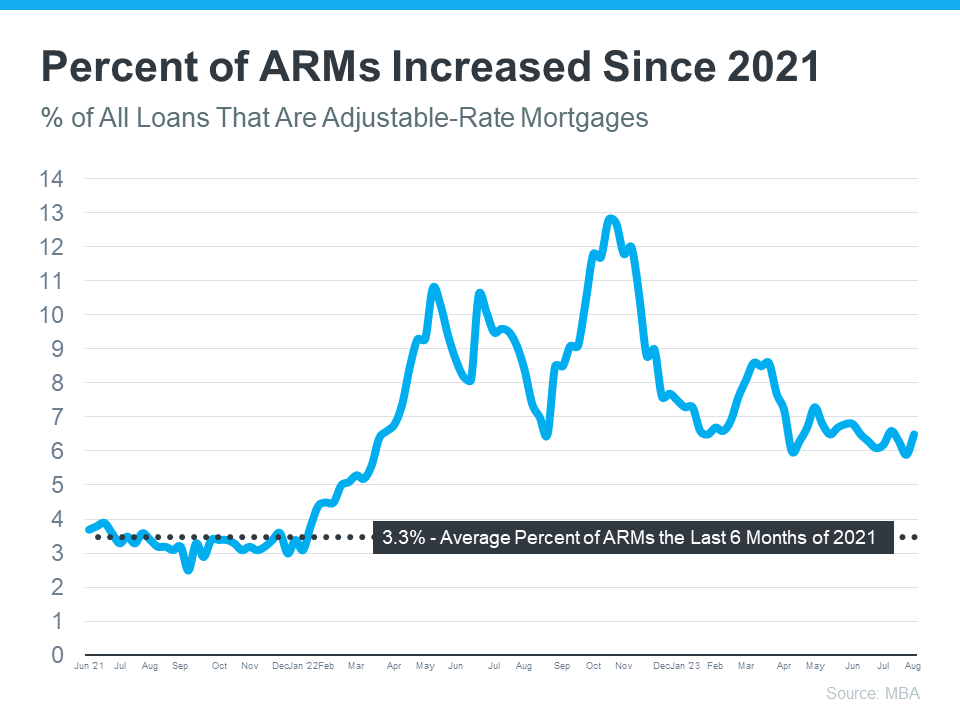

This graph uses data from the Mortgage Bankers Association (MBA) to show how the percentage of adjustable-rate mortgages has increased over the past few years:

As the graph conveys, after hovering around 3% of all mortgages in 2021, many more homeowners turned to adjustable-rate mortgages again last year. There’s a simple explanation for that increase. Last year is when mortgage rates climbed dramatically. With higher borrowing costs, some homeowners decided to take out this type of loan because traditional borrowing costs were high, and an ARM gave them a lower rate.

Why Today’s ARMs Aren’t Like the Ones in 2008

To put things into perspective, let’s remember these aren’t like the ARMs that became popular leading up to 2008. Part of what caused the housing crash was loose lending standards. Back then, when a buyer got an ARM, banks and lenders didn’t require proof of their employment, assets, income, etc. Basically, people were getting loans that they shouldn’t have received. This set many homeowners up for trouble because they couldn’t pay back the loans that they were never qualified for.

This time around, lending standards are different. Banks and lenders learned from the crash, and now they verify income, assets, employment, and more. This means today’s buyers actually have to qualify for their loans and show they’ll be able to repay them.

Archana Pradhan, Economist at CoreLogic, says the difference between then and now is that starting “in 2005, 29% of ARM borrowers had credit scores of below 640…Currently almost all conventional loans, including both ARMs and Fixed-Rate-Mortgages, require full documentation, are amortized, and are made to borrowers with credit scores above 640.”

(A credit score of 640 is considered by lenders to be “fair.”)

In simple terms, Laurie Goodman at Urban Institute says that ” Today’s Adjustable-Rate Mortgages are no riskier than other mortgage products and the lower monthly payments could increase access to homeownership for more buyers.”

Bottom Line

If you’re a first-time homebuyer and would like to learn more about lending options that could help you overcome today’s affordability challenges, let’s connect at 508-360-5664 or [email protected]. We work with several reputable and trustworthy lenders and can introduce you.

We didn’t plan it this way, but it’s timely that our topic this week is ARMs. Today is Labor Day and we’re reminded of the number of hard working people — particularly those who are younger — for whom the dream of owning a home seems out of reach because of affordability issues.

There have been a number of positive changes in the housing market that they may not be aware of. Responsible ARMs is one, Another is that the 20% down payment that your Uncle Bob “who knows a little something about real estate” insists is necessary, isn’t.

Today’s housing inventory is tight, but not impossible. The data shows that eight homes are sold every minute. There’s no reason why you can’t be the next buyer. (Or seller!)

Happy Labor Day. Enjoy and be safe.

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass