Don't Be Rate-Locked in Your Own Home

The biggest challenge facing the housing market is the limited number of homes that are for sale. Mark Fleming, Chief Economist at First American, says the root cause of today’s low supply is “…rate locked existing homeowners and the fear of not finding something to buy.”

So, let’s examine this.

Rate-Locked Homeowners

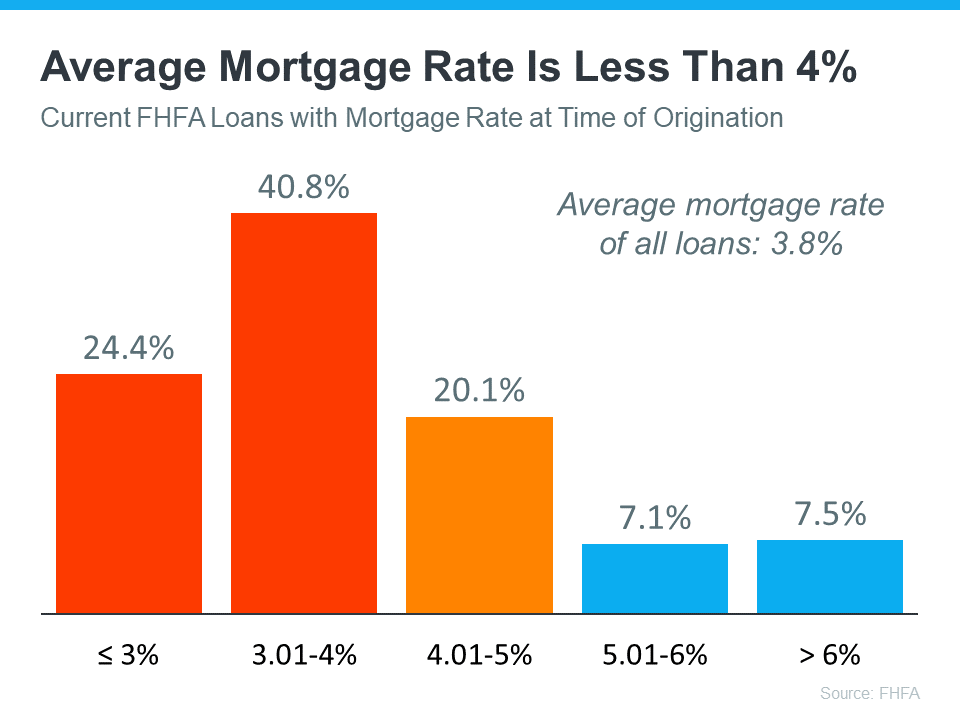

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical mortgage rate offered to buyers is higher. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked.

When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will continue to fall this year, and that could mean more people will be willing to move as that happens. Waiting for rates to drop back to 3% is probably a losing strategy, as Mari explained in a recent posting on our YouTube channel. Waiting for 3% Rates?

The Fear of Not Finding Something To Buy

The other factor holding back potential sellers is the fear of not finding another home to buy. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options, which may include newly built homes and condominiums.

What Does This Mean for You?

These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market has a sweet spot that can work to your advantage.

According to ATTOM: 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.”

This can make a major difference when you move as the equity you have in your current home can keep the cost of your next home down. (That was our strategy when we moved last year.) Your interest rate may be higher, but your mortgage payment could remain the same or possibly lower.

There’s also more to consider when deciding to sell your current home than interest rates.

A house that is too small now is only going to shrink more as your family grows. A home that’s too big now is only going to get bigger as time goes on and you totally stop using the second level. Waiting could cost you the opportunity to purchase the house that’s perfect for you.

Some Suggestions

It’s important to understand the real dollars and cents difference between your current mortgage rate and the one you would qualify for, especially if you use your home’s equity to power your move. (It may not be as much as you think.)

If you don’t have a relationship with a reputable lender, we can connect you with several. Just let us know at 508-360-5664 or [email protected]. They can give you a good sense of what your new payments could be.

One thing that hasn’t changed is the answer to the question: “But, where can I go?” It’s still where ever you want. That neighborhood you want to move to is still that neighborhood you want to move to.

So, it’s important to identify the areas and types of houses that you’re interested in, as well as know your “must haves” and “would likes” in your new home.

Having done it ourselves last spring, we can help you develop a plan to sell your current home and successfully move to the house that fits your needs and lifestyle today.

You don’t have to be rate-locked into where you are.

Talk soon…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass