Why Today’s Housing Market Isn’t Like 2008

With another uptick in mortgage interest rates and all the media talk about a shift in the housing market, you might be thinking we’ve entered a housing bubble. But the good news is, that there’s concrete data to show why this is nothing like the last time.

There’s Still a Shortage of Homes on the Market Today, Not a Surplus

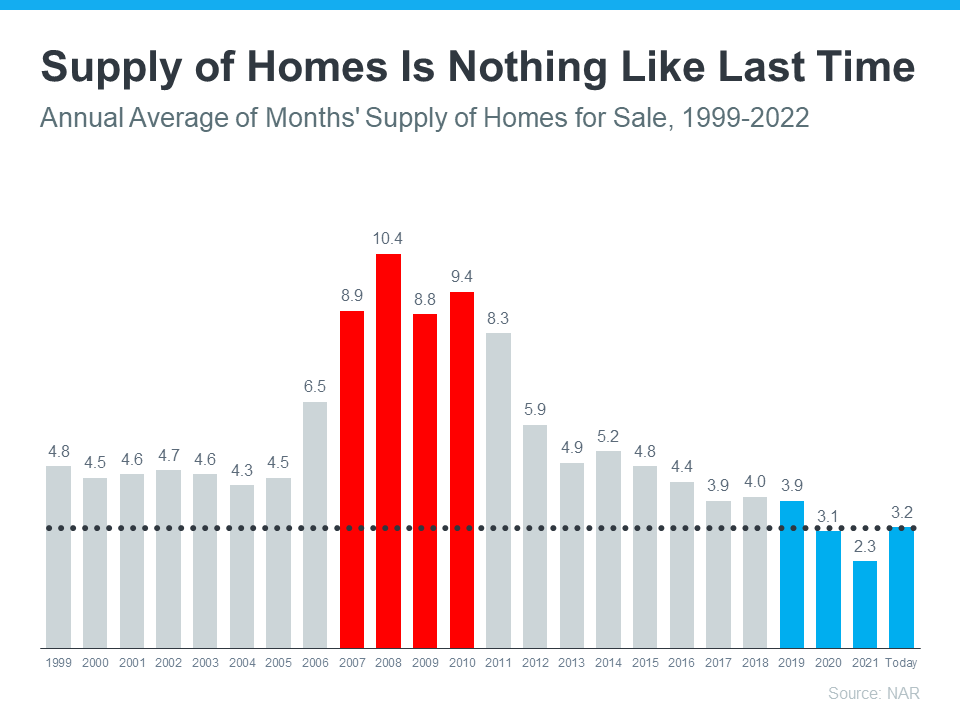

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

On Cape Cod, there is a little over a two month’s supply of homes. While this is certainly an increase over past months, it’s not would be considered a normal market. So, with demand still strong and inventory tight, prices will remain steady. Decreases will come on a house-by-house basis determined by the initial asking price, condition, competition, buyer interest, etc.

Mortgage Standards Were Much More Relaxed Back Then

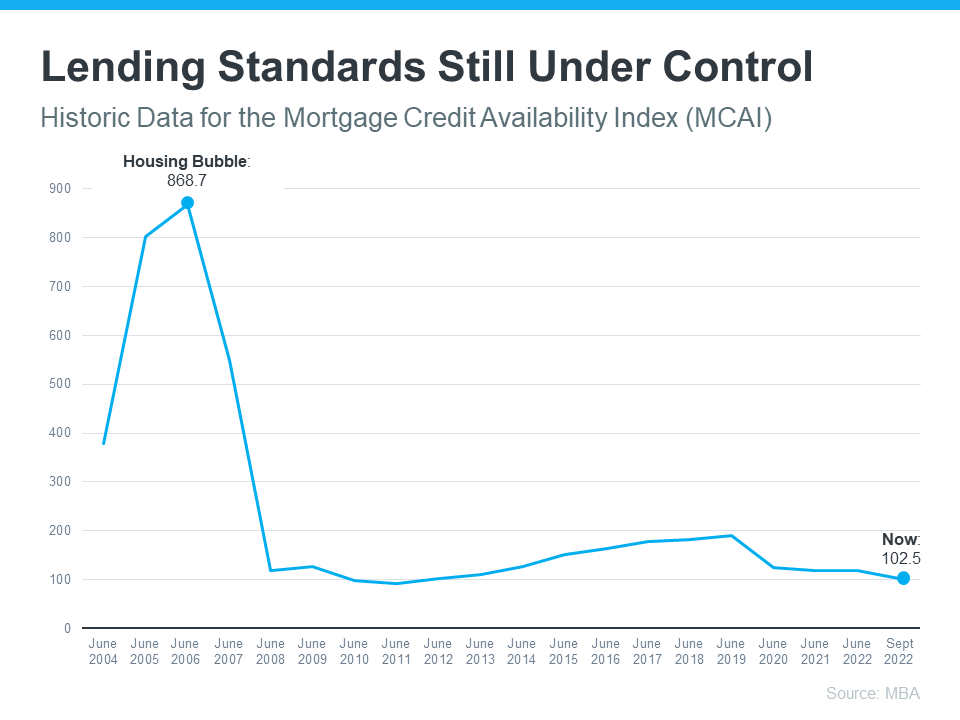

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home.

Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. (Mari recalls going to closings where buyers signed paperwork for three loans!)

Today, things are different, and purchasers face much higher standards from mortgage companies.

The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time.

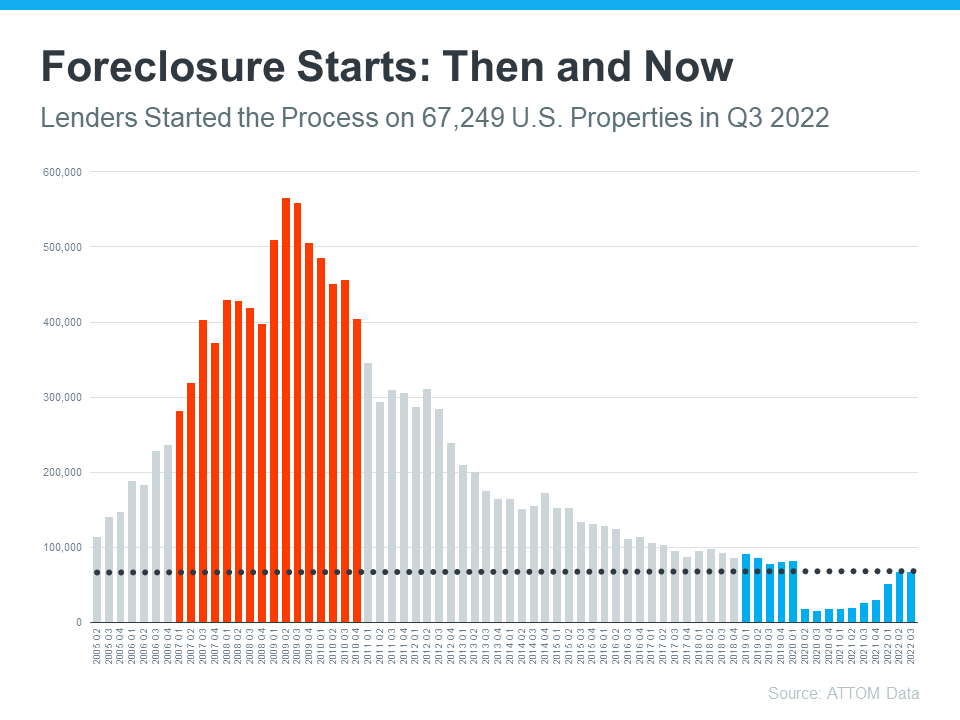

The Foreclosure Volume Is Nothing Like It Was During the Crash

Another difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic: “the total average equity per borrowers has now reached almost $300,000, the highest in the data series.”

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has: “very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

This shows that homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

Bottom Line

So, if you’re concerned that the same decisions that led to the last housing crash are being made again, this information should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

If you have questions and concerns, please let’s connect at 508-360-5664 or [email protected]. We’re in touch with experts not only on Cape, but across the country. We’ll give you honest answers and help guide you to the best decisions for you and your family.

Please be careful tonight as trick or treaters will be out at the same time as many of us are coming home work. They’re not always easy to see, so please be careful, especially on dark streets.

Let’s make it a Happy Halloween.

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass