What's Next for Home Prices

As the housing market cools in response to the rise in mortgage rates, home price appreciation is slowing as well. If you’re following the headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation.

But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections, so you have the best information available today.

What the Experts Are Saying About Home Prices Next Year

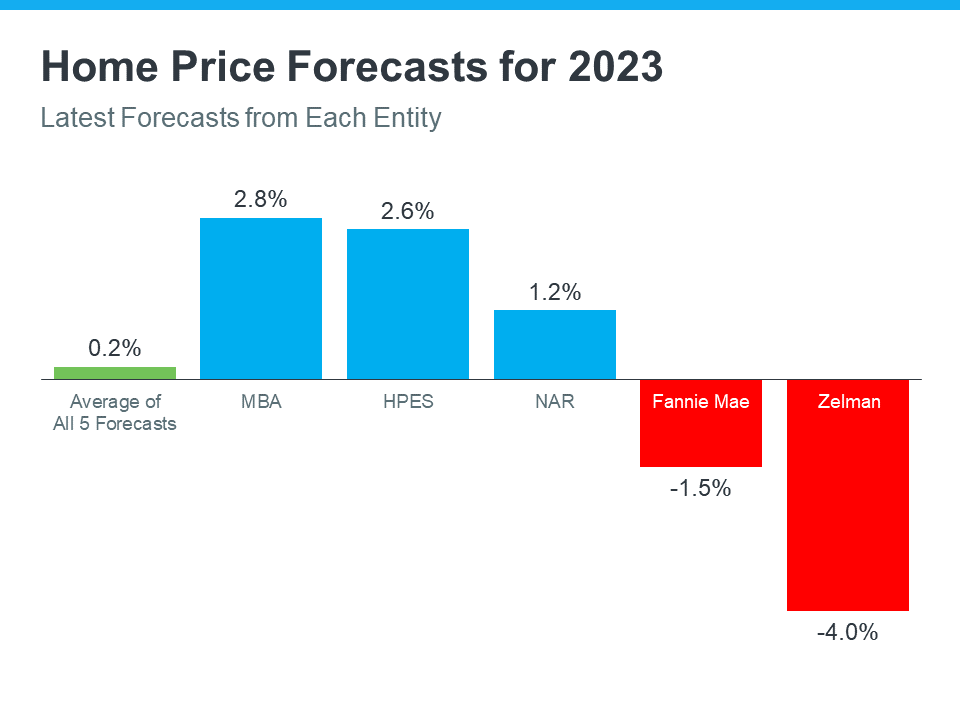

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

Prices vary from market-to-market and parts of the country. We’re friendly with colleagues in our business from across the country and watch them market homes for $450,000.00, for example, that would fetch $650,00.00 or more here.

What’s not going to happen is a dramatic drop in prices that some buyers are waiting for. No reputable expert is predicting the “crash” that would allow that to occur.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices could drop slightly in 2023, they also think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says: “In the absence of trustworthy, up-to-date information, real estate decisions are increasingly driven by fear, uncertainty and doubt.”:

As “Prof Hank” explained in a recent video posted to our YouTube channel, the media is not your best source of information.

So, don’t let fear, uncertainty or misinformation change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, let’s connect.

Please consider subscribing to our YouTube channel where we post up-to–date information for buyers and sellers that is pertinent to where we live. Or let’s chat at 508-360-5664 or [email protected].

As we’ve mentioned before, we sold and bought earlier this year, so we had many of the same questions and concerns as homeowners as you might have. We’re happy to share with you what we learned as homeowners, as well as our perspective as real estate professionals.

Let’s talk soon…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass