Homeownership Is Worth it

When you’re getting ready to buy your first home, there’s always a well intentioned family member or friend whispering in your ear telling you that it’s not worth it.

“Just rent,” they say. “You don’t need the aggravation.”

“A house is a money pit. There’s always something.”

“Think about all you’ll save by not paying property taxes.”

But, respondents to a recent Fannie Mae consumer survey beg to differ. According to them, the top four financial benefits of owning a home are:

- 88% – a better chance of saving for retirement

- 87% – the best investment plan

- 85% – the chance to be better off financially

- 85% – the chance to build up wealth

Additional financial advantages of homeownership mentioned in the survey are having the best overall tax situation and being able to live within your budget.

Does homeownership actually give you a better chance to build wealth?

No one can question a person’s unique feelings about the importance of homeownership. However, it’s fair to ask if the numbers justify homeownership as a financial asset.

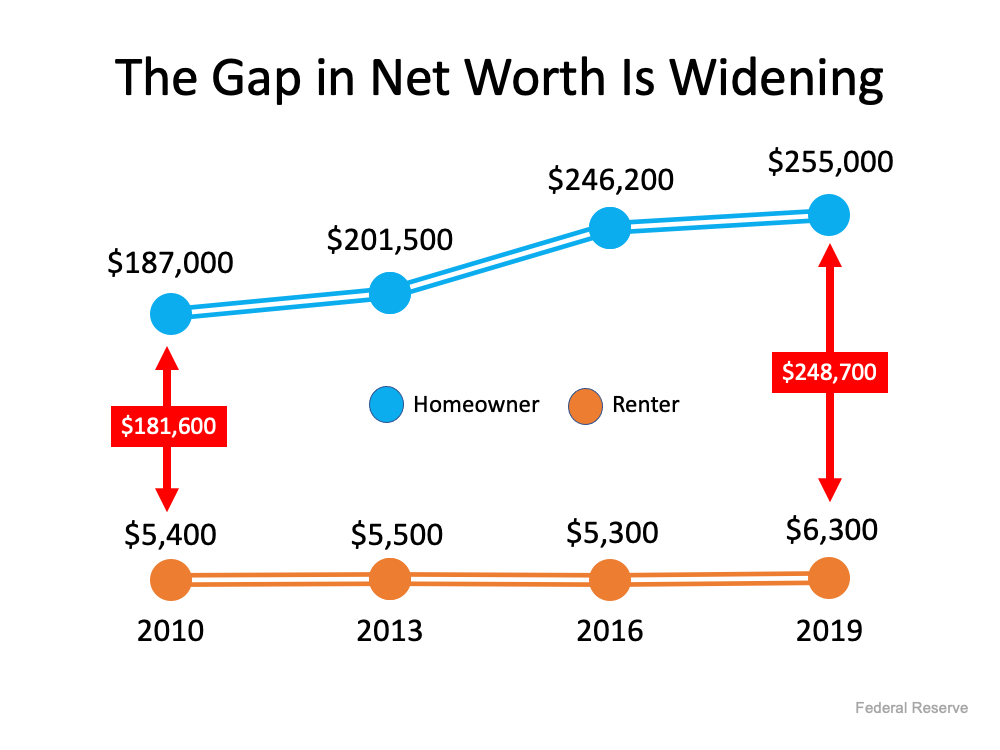

Last fall, the Federal Reserve released the Survey of Consumer Finances, a report done every three years, with the latest edition covering through 2019. Their findings confirmed that homeownership is a clear financial benefit. The survey found that homeowners have forty times higher net worth than renters ($255,000 for homeowners compared to $6,300 for renters).

The difference in net worth between homeowners and renters has continued to grow. Here’s a graph showing the results of the last four Fed surveys:The above graph only includes data through 2019, but according to CoreLogic, the equity held by homeowners grew by $26,300 over the last twelve months alone. That means the gap between the net worth of homeowners and renters has probably widened even further over the last year.

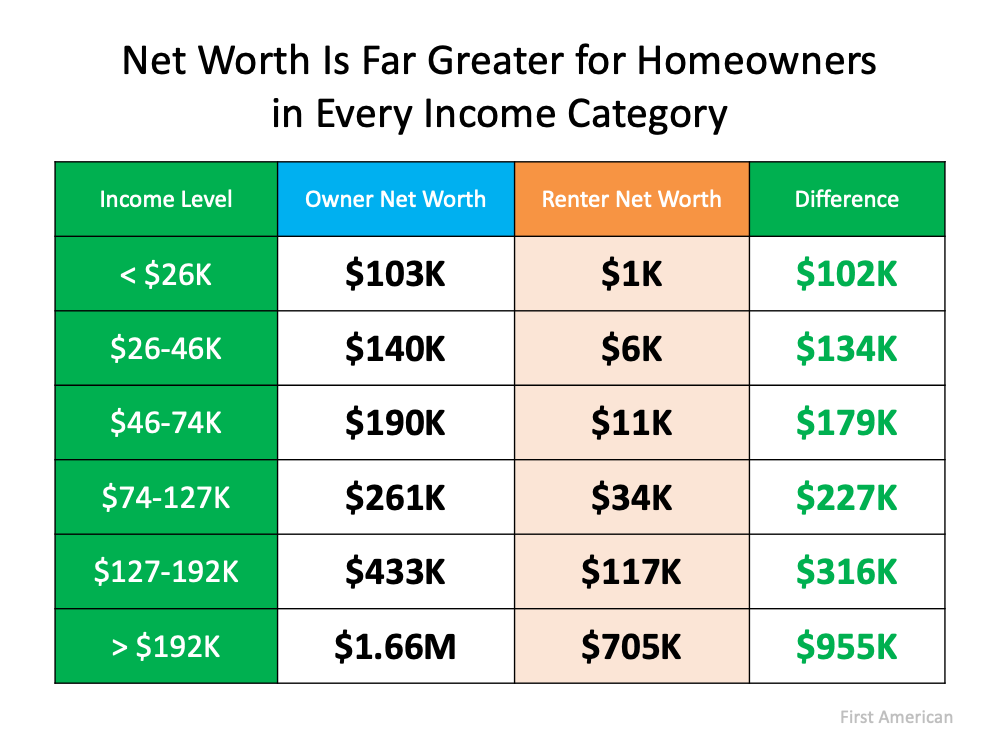

Some might argue the difference in net worth may be due to homeowners normally having larger incomes than renters and therefore the ability to save more money. However, a study by First American shows homeowners have greater net worth than renters regardless of their income level. Here are the findings :Others may think homeowners are older and that’s why they have a greater net worth. However, a Joint Center for Housing Studies of Harvard University report on homeowners and renters over the age of 65 reveals:

Homeowners 65 and older have 47.6 times greater net worth than renters.

“The ability to build equity puts homeowners far ahead of renters in terms of household wealth…the median owner age 65 and over had home equity of $143,500 and net wealth of $319,200. By comparison, the net wealth of the same-age renter was just $6,700.”

Clearly homeownership is worth the “aggravation” as it is a direct way to build your net worth.

So, thank well meaning family and friends for their concern. Then let’s connect at 508-568-8191 or [email protected] to discuss your options. Helping our clients — including many first time homebuyers — make the best decisions for their individual situations has been our full time job for more than 20 years. Let’s talk soon…

Don’t wish for it; go for it!

Mari and Hank

Bottom Line

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass