Thinking about Retirement?

As more baby boomers enter retirement age, the question of whether they should sell their homes and downsize has become a hot topic. In today’s housing market, with low available inventory in the starter and trade-up home categories, it makes sense to consider if your home can adapt to your needs, if you are considering aging in place. As emotionally attached as you may be to your home, selling could be the best option.

This week and next, we’ll be sharing with you — courtesy of industry resource KCM (Keeping Current Matters) — the factors that the National Association of Exclusive Buyer Agents suggest you consider when making a decision about your retirement living.

Affordability

“It may be easy enough to purchase your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $9,700 in equity last year.

Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind of not having to do the maintenance work yourself?

Do you have questions about your home and how it might fare in today’s market? We’d be happy to meet with you and discuss your options. Please contact us via the comment section or by calling 508-568-8191, so we can arrange a convenient time to talk.

Next week: security, mobility, convenience, and pets.

——————–

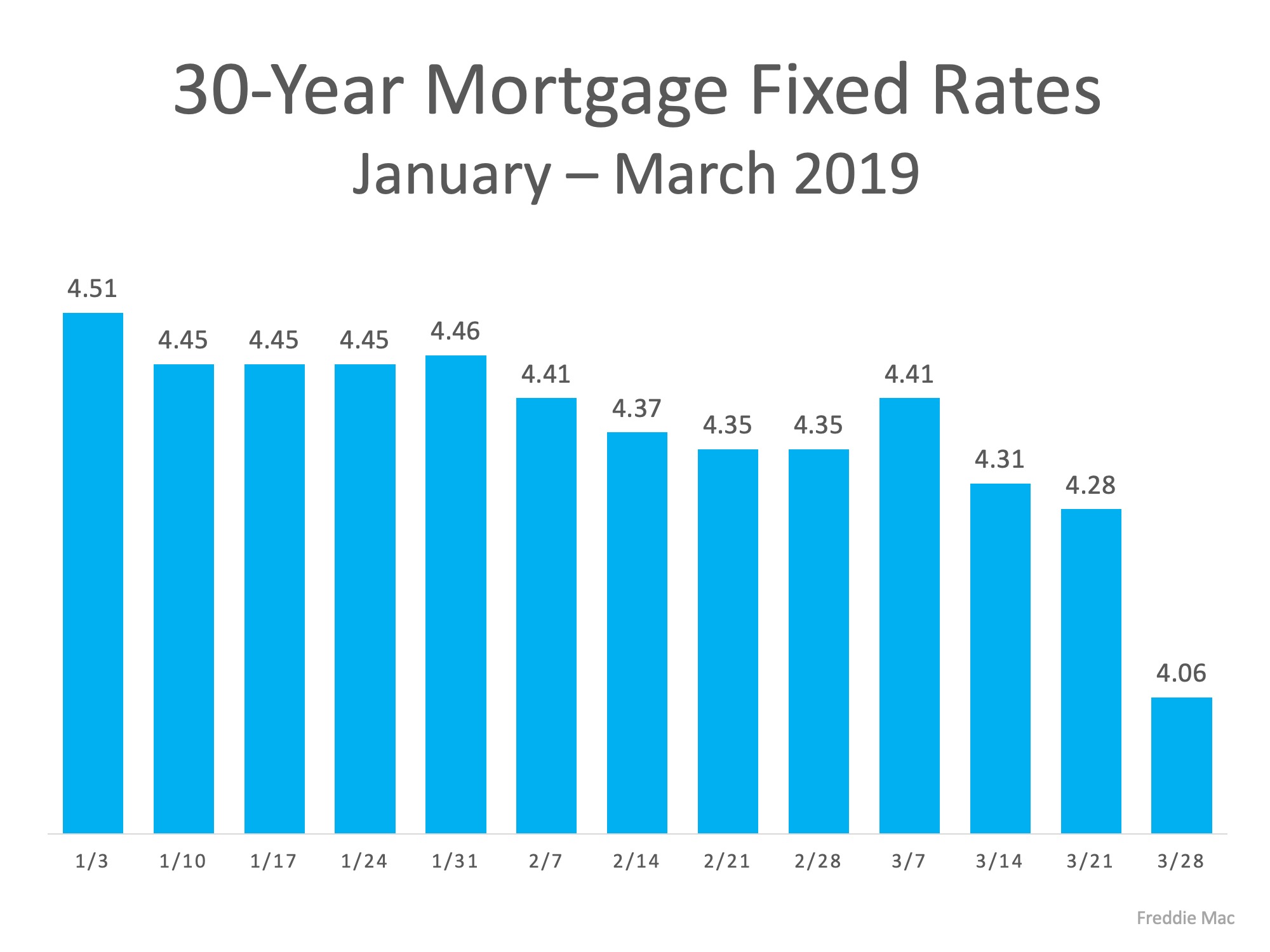

Mortgage Rates Remain Low

For those who were concerned about mortgage rates rising, the following graph should calm your fears.

____________________

TRE and United Way

This week, Today Real Estate(TRE) management and staff will be participating in a United Way of Cape Cod and the Islands Day of Caring project at Cape Abilities in Orleans. Our President Todd Machnik is also the current Chair of the United Way Board of Directors. One way that TRE demonstrates it strong commitment to the community is by active involvement with United Way. In addition to Machnik’s leadership role, Mari and several other TRE professionals serve on committees.

Enjoy your week…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass